Keeping track of your finances is essential for managing your money effectively. One tool that can help you stay organized is a checkbook register. By recording all your transactions in a checkbook register, you can easily track your spending, monitor your account balance, and avoid overdraft fees.

For those who prefer a more traditional approach to managing their finances, a printable checkbook register template can be a great resource. With a printable template, you can easily fill in your transactions by hand and keep a physical record of your finances. Plus, it’s a cost-effective solution for those who prefer not to use digital tools.

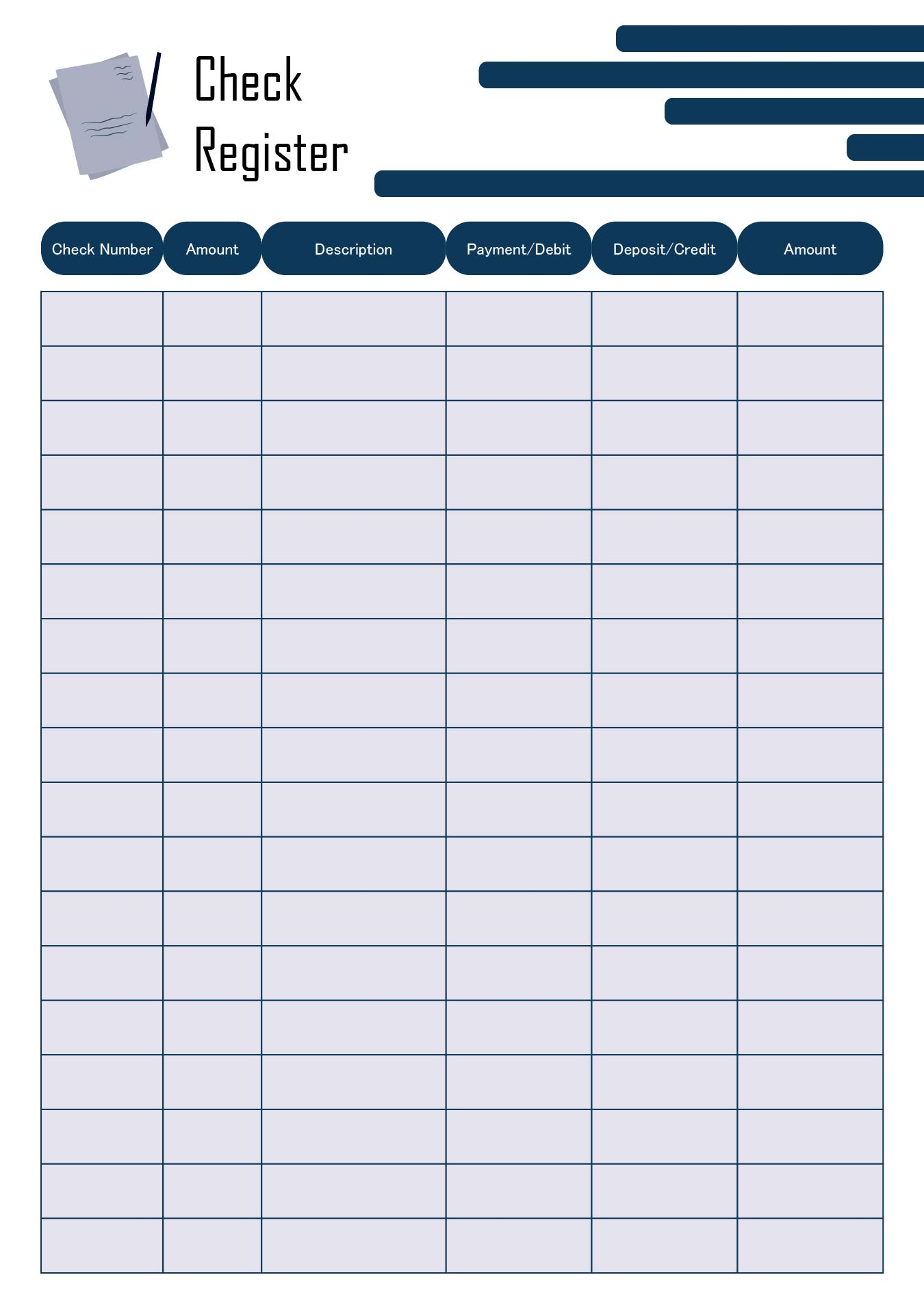

Checkbook Register Template Printable Free

There are many websites that offer free printable checkbook register templates that you can download and print at home. These templates typically include columns for the date, transaction description, check number, debit amount, credit amount, and balance. Some templates also have additional columns for categorizing your expenses or noting the purpose of each transaction.

When using a printable checkbook register template, it’s important to update it regularly to ensure that your records are accurate and up to date. By entering your transactions in a timely manner, you can avoid missing any expenses or payments and have a clear picture of your financial situation.

Another benefit of using a printable checkbook register template is that you can customize it to suit your specific needs. Whether you prefer a simple layout or a more detailed design, you can find a template that works for you. You can also choose a template that fits the size of your checkbook or binder for easy organization.

In conclusion, a printable checkbook register template can be a valuable tool for managing your finances effectively. By keeping track of your transactions and monitoring your account balance, you can stay on top of your financial goals and avoid any unnecessary fees. With the convenience and flexibility of a printable template, you can take control of your finances and make informed decisions about your money.