As we approach the tax season for the year 2023, it’s important for taxpayers to be aware of the changes and updates to the qualified dividends and capital gain tax worksheet. This worksheet plays a crucial role in determining the tax obligations for individuals who have received dividends or realized capital gains during the tax year.

Understanding how to properly fill out this worksheet can help taxpayers accurately calculate their tax liabilities and ensure compliance with the Internal Revenue Service (IRS) regulations. By familiarizing yourself with the rules and guidelines outlined in the worksheet, you can make informed decisions regarding your investments and financial planning strategies.

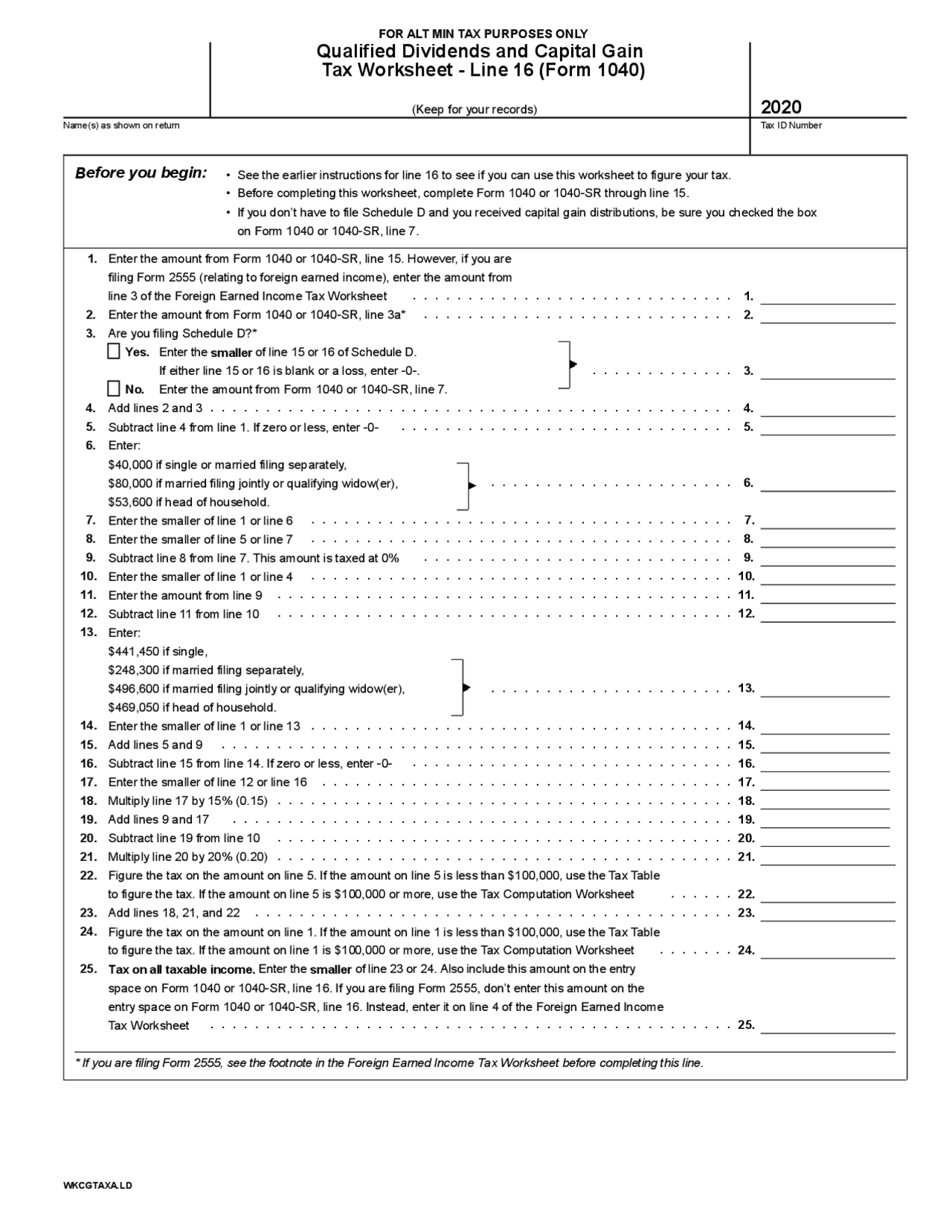

2023 Qualified Dividends and Capital Gain Tax Worksheet

The 2023 qualified dividends and capital gain tax worksheet provides a step-by-step process for calculating the tax on qualified dividends and capital gains. This worksheet takes into account various factors such as the type of investment, holding period, and tax rates to determine the taxable amount and the corresponding tax liability.

By following the instructions on the worksheet, taxpayers can determine the portion of their dividends and capital gains that qualify for preferential tax treatment. This can result in lower tax rates for these types of investment income, providing a significant tax benefit for investors.

It’s important to note that the tax rates for qualified dividends and capital gains may vary depending on the taxpayer’s filing status and total income. By using the 2023 worksheet, individuals can accurately calculate their tax liabilities and plan accordingly to minimize their tax burden.

Additionally, the worksheet also helps taxpayers determine if they are eligible for any tax credits or deductions related to qualified dividends and capital gains. By taking advantage of these tax incentives, individuals can further reduce their overall tax liabilities and maximize their after-tax returns on investments.

In conclusion, the 2023 qualified dividends and capital gain tax worksheet is a valuable tool for taxpayers to assess and calculate their tax obligations related to investment income. By understanding how to properly fill out this worksheet and leverage the tax benefits available, individuals can optimize their financial strategies and achieve their long-term financial goals.