As the new year approaches, many individuals and businesses are beginning to think about their taxes for the upcoming year. One tool that can be helpful in this process is the 2024 tax computation worksheet. This worksheet can assist in calculating the amount of taxes owed and can help ensure that individuals and businesses are prepared when tax season arrives.

The 2024 tax computation worksheet is a valuable resource for individuals and businesses to use when determining their tax liability for the year. By inputting relevant financial information, such as income, deductions, and credits, individuals and businesses can calculate their tax liability and make any necessary adjustments to ensure they are in compliance with tax laws.

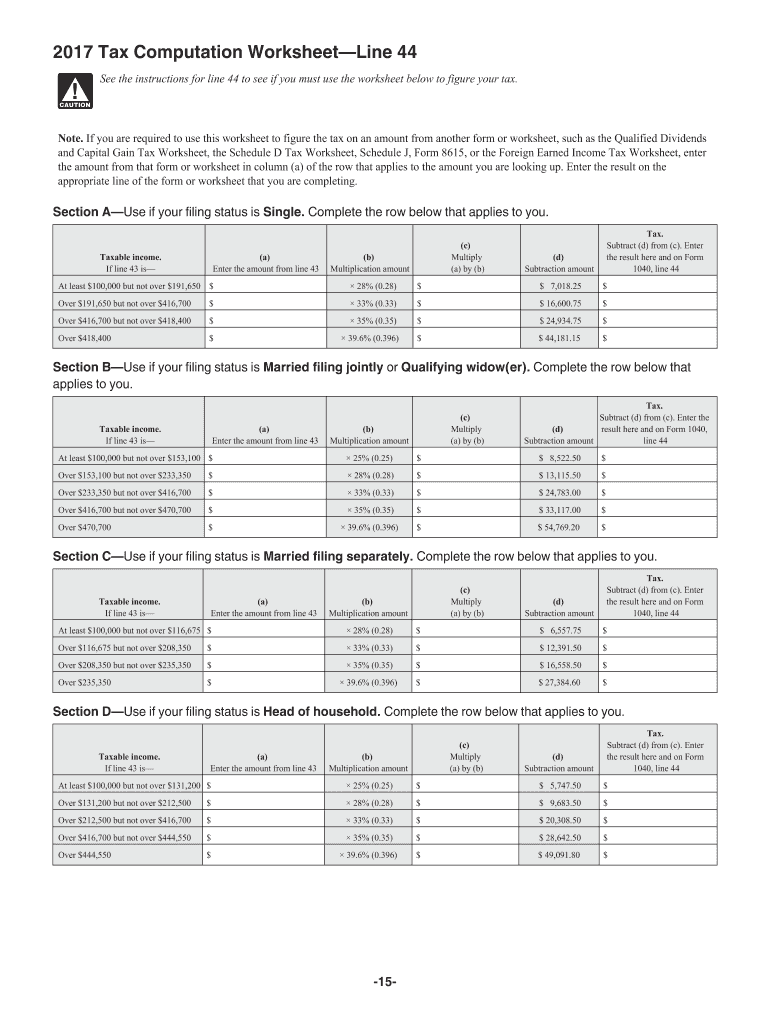

2024 Tax Computation Worksheet

When using the 2024 tax computation worksheet, individuals and businesses should gather all relevant financial documents, such as W-2s, 1099s, and receipts for deductions. By accurately inputting this information into the worksheet, individuals and businesses can calculate their tax liability for the year and identify any potential areas for tax savings.

One key benefit of using the 2024 tax computation worksheet is that it can help individuals and businesses plan for their tax liability throughout the year. By regularly updating the worksheet with new financial information, individuals and businesses can stay informed about their tax liability and make any necessary adjustments to ensure they are prepared when tax season arrives.

In addition to calculating tax liability, the 2024 tax computation worksheet can also help individuals and businesses identify potential tax credits and deductions that they may be eligible for. By carefully reviewing the worksheet and consulting with a tax professional, individuals and businesses can take advantage of any available tax savings opportunities and reduce their overall tax liability.

Overall, the 2024 tax computation worksheet is a valuable tool for individuals and businesses to use when preparing for tax season. By accurately inputting financial information, identifying potential tax savings opportunities, and regularly updating the worksheet throughout the year, individuals and businesses can ensure they are prepared and compliant with tax laws when tax season arrives.