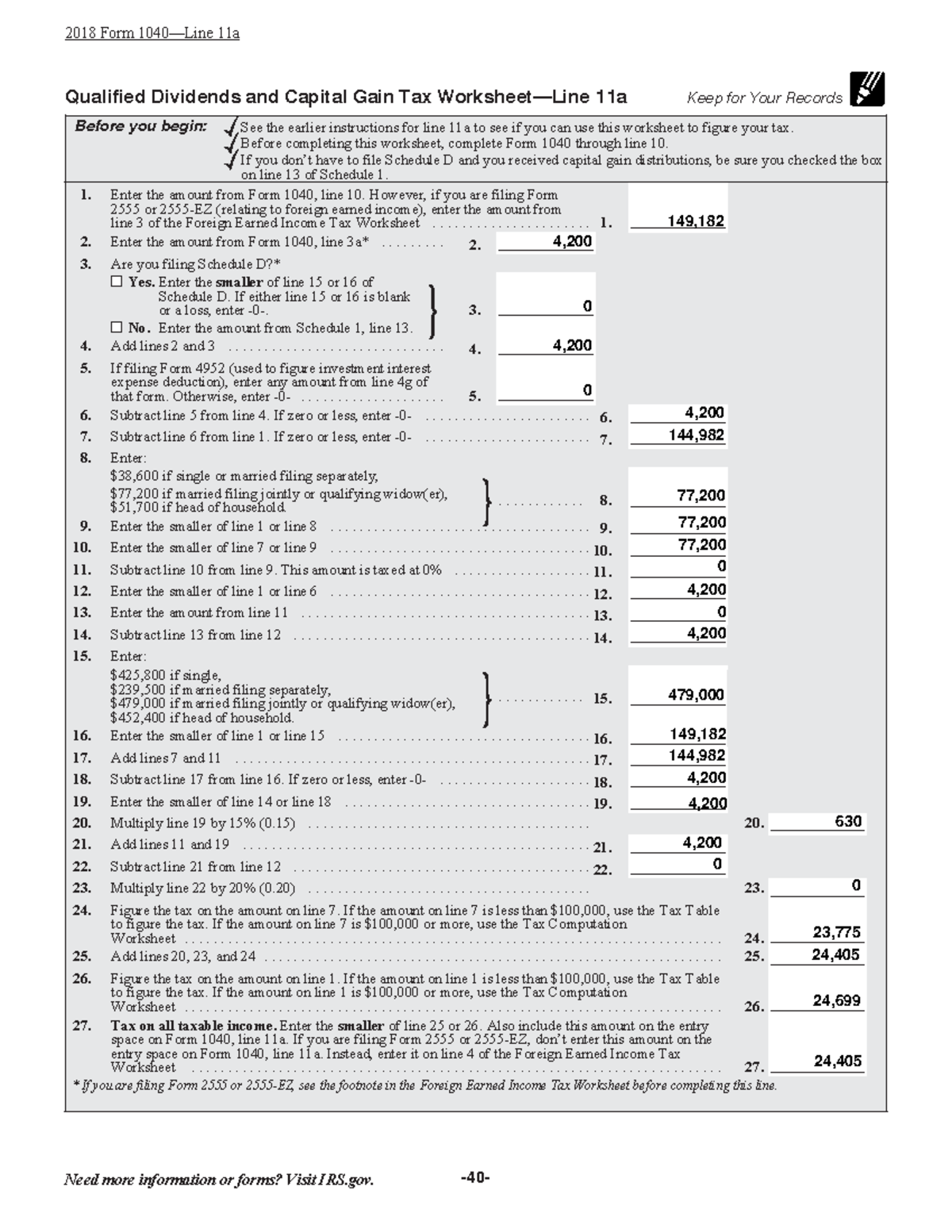

As we approach the tax season for the year 2023, it is important to understand the various forms and worksheets that may be required for filing. One such important document is the Qualified Dividends and Capital Gains Worksheet, which helps taxpayers calculate the tax on their investment income. This worksheet is crucial for those who have received dividends or realized capital gains during the tax year.

Understanding how to properly fill out the 2023 Qualified Dividends and Capital Gains Worksheet PDF can help taxpayers accurately report their investment income and determine the tax owed. This worksheet is used to determine the tax rate on qualified dividends and capital gains, which are taxed at a lower rate than ordinary income. By correctly completing this worksheet, taxpayers can potentially reduce their tax liability and maximize their savings.

When completing the 2023 Qualified Dividends and Capital Gains Worksheet PDF, taxpayers will need to gather information such as the total amount of qualified dividends and capital gains received, as well as any adjustments or modifications that may affect the taxable amount. It is important to carefully follow the instructions provided on the worksheet to ensure accurate calculations and reporting.

Additionally, taxpayers should be aware of any changes to the tax laws or regulations that may impact the treatment of qualified dividends and capital gains. Staying informed about updates to the tax code can help taxpayers make informed decisions and take advantage of any potential tax-saving opportunities.

Overall, the 2023 Qualified Dividends and Capital Gains Worksheet PDF is a valuable tool for taxpayers with investment income. By understanding how to properly complete this worksheet and staying informed about relevant tax laws, taxpayers can effectively manage their tax liability and make the most of their investment income.

As tax season approaches, it is important for taxpayers to familiarize themselves with the necessary forms and worksheets, including the 2023 Qualified Dividends and Capital Gains Worksheet PDF. By properly completing this worksheet and staying informed about tax laws, taxpayers can ensure accurate reporting of their investment income and potentially reduce their tax liability.