When it comes to paying taxes, it’s important to stay on top of your financial responsibilities to avoid any penalties or interest charges. One way to ensure you’re meeting your tax obligations throughout the year is by using an estimated tax worksheet. This tool can help you calculate how much you should be paying in taxes based on your income and deductions.

Many people are required to pay estimated taxes if they have income that is not subject to withholding, such as self-employment income, interest, dividends, alimony, or rental income. By using an estimated tax worksheet, you can avoid a large tax bill at the end of the year and spread out your payments evenly over the course of the year.

Estimated Tax Worksheet

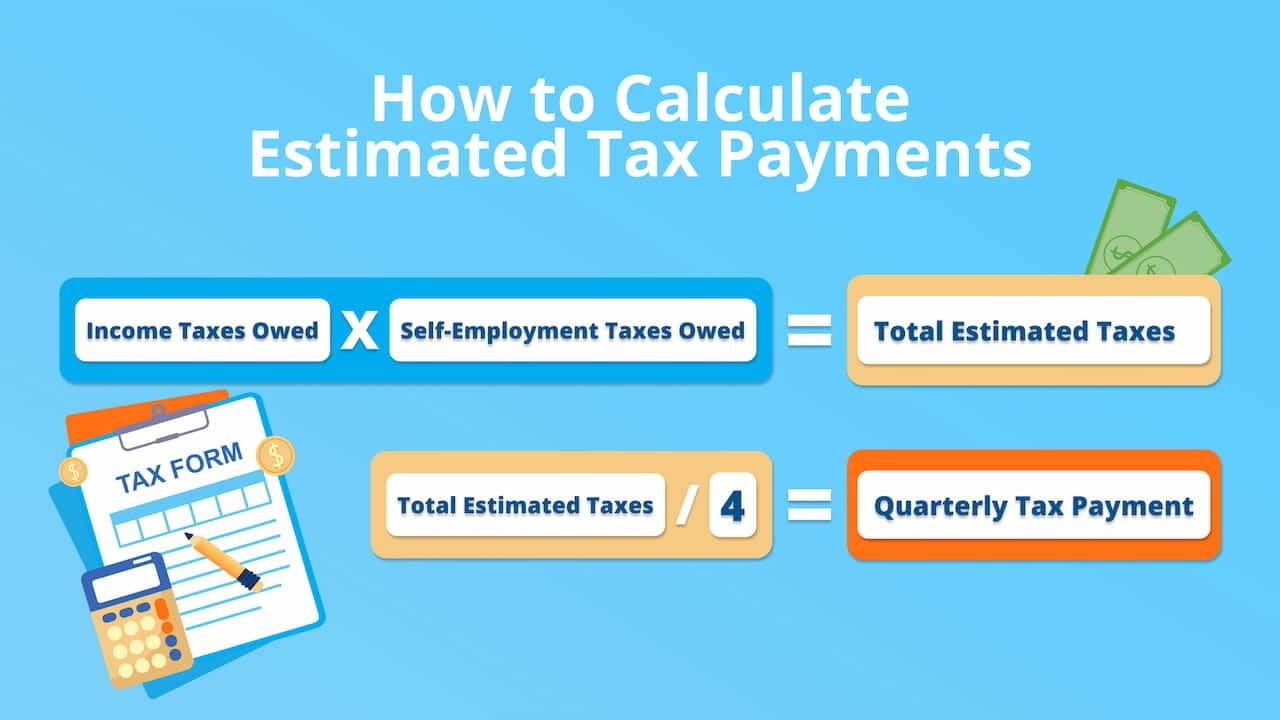

The estimated tax worksheet typically includes sections for entering your total income, deductions, credits, and tax payments already made. By filling out this worksheet, you can determine your estimated tax liability for the year and figure out how much you need to pay each quarter to avoid underpayment penalties.

It’s important to keep in mind that the estimated tax worksheet is just an estimate and your actual tax liability may vary. Changes in your income or deductions throughout the year can impact your tax payments. It’s a good idea to review your estimated tax worksheet periodically and make adjustments as needed.

If you find that you have underpaid your estimated taxes, you may be subject to penalties and interest charges. It’s best to stay proactive and make sure you’re paying enough throughout the year to avoid any surprises come tax time. The estimated tax worksheet can help you stay organized and on track with your tax payments.

In conclusion, the estimated tax worksheet is a useful tool for individuals who need to pay estimated taxes throughout the year. By using this worksheet, you can calculate your tax liability, make timely payments, and avoid penalties and interest charges. It’s important to stay informed about your tax obligations and use tools like the estimated tax worksheet to help you stay on track.