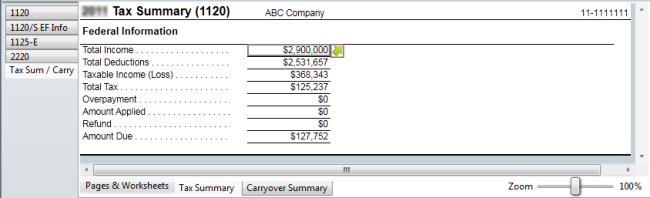

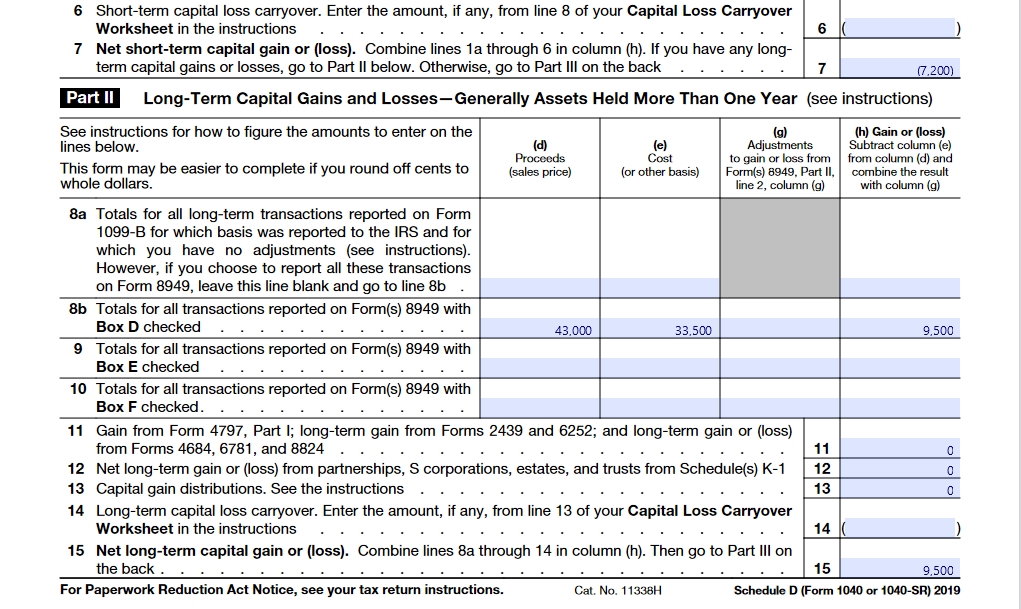

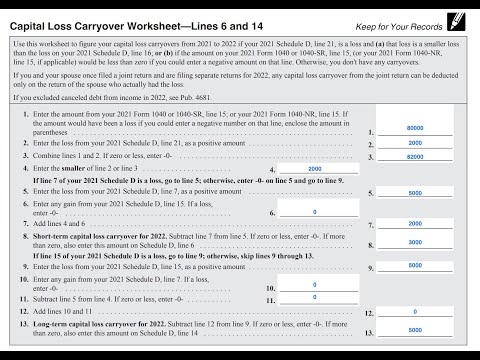

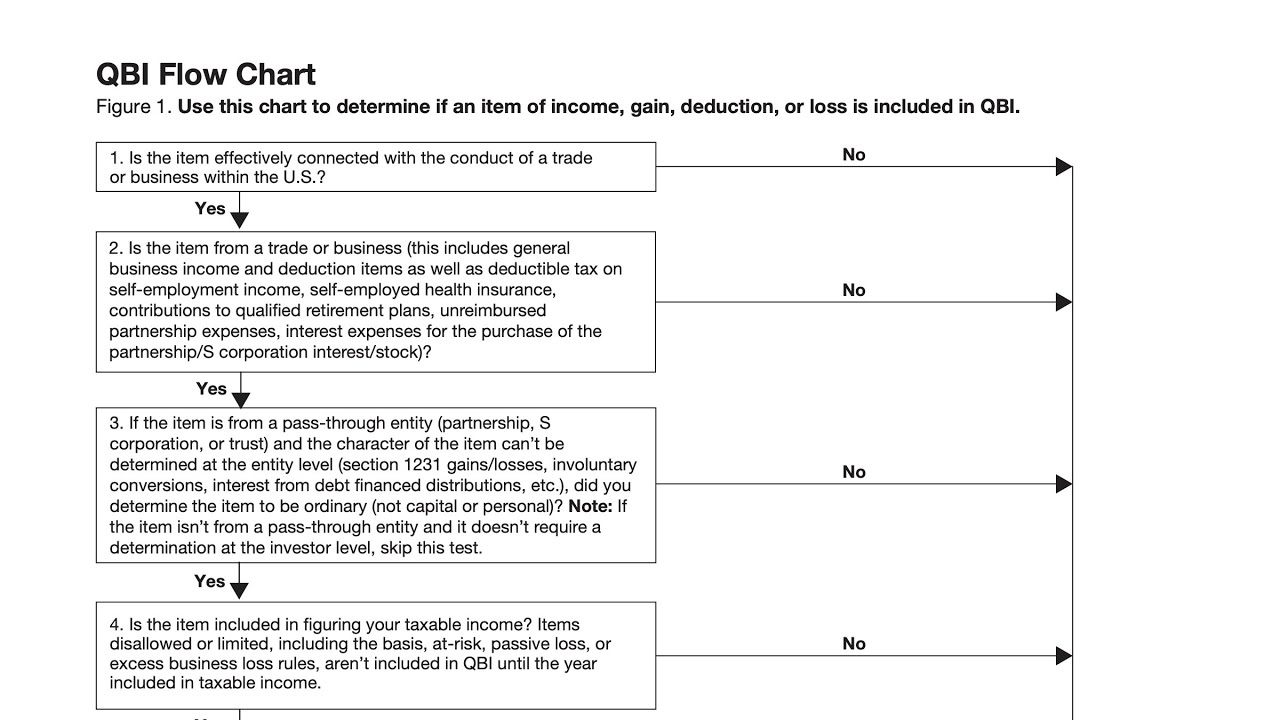

When it comes to taxes, understanding carryover provisions can be crucial for maximizing deductions and credits. One important tool in this process is the federal carryover worksheet, which helps taxpayers keep track of any unused deductions or credits that can be carried over to future years.

The federal carryover worksheet is a handy tool provided by the IRS to help taxpayers keep track of any unused deductions or credits from previous years. This worksheet is especially helpful for taxpayers who have experienced a loss or have had deductions or credits that exceeded their tax liability in a given year.

Using the federal carryover worksheet, taxpayers can document any unused deductions or credits and carry them forward to future tax years. This can help reduce tax liability in future years and maximize the benefits of any deductions or credits that were not fully utilized in the past.

By carefully filling out the federal carryover worksheet each year, taxpayers can ensure that they are taking full advantage of any carryover provisions available to them. This can result in significant tax savings over time and help taxpayers make the most of any deductions or credits that may have been overlooked in the past.

In conclusion, the federal carryover worksheet is a valuable tool for taxpayers looking to maximize their deductions and credits over time. By keeping careful track of any unused deductions or credits and carrying them forward to future years, taxpayers can reduce their tax liability and take full advantage of any available tax benefits. Be sure to utilize the federal carryover worksheet each year to ensure you are getting the most out of your tax situation.