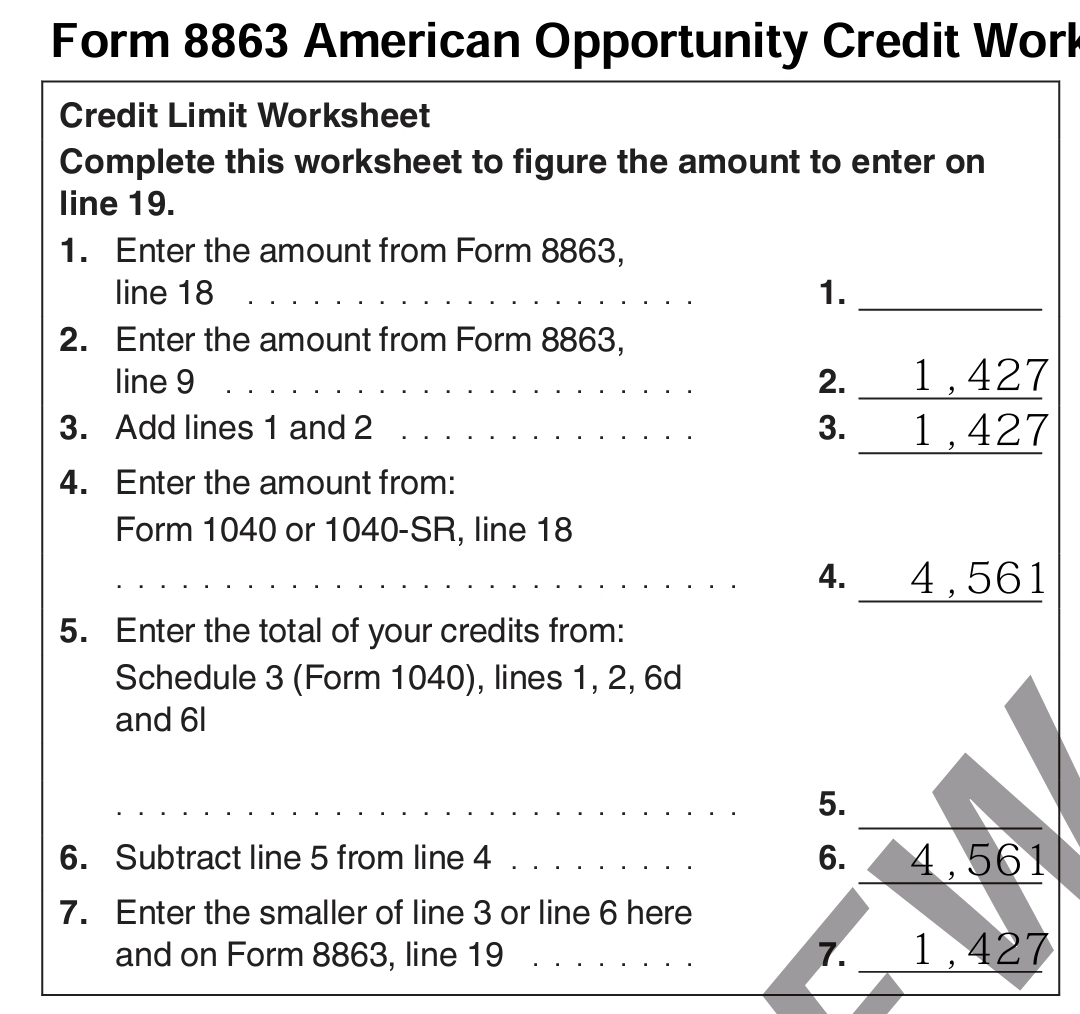

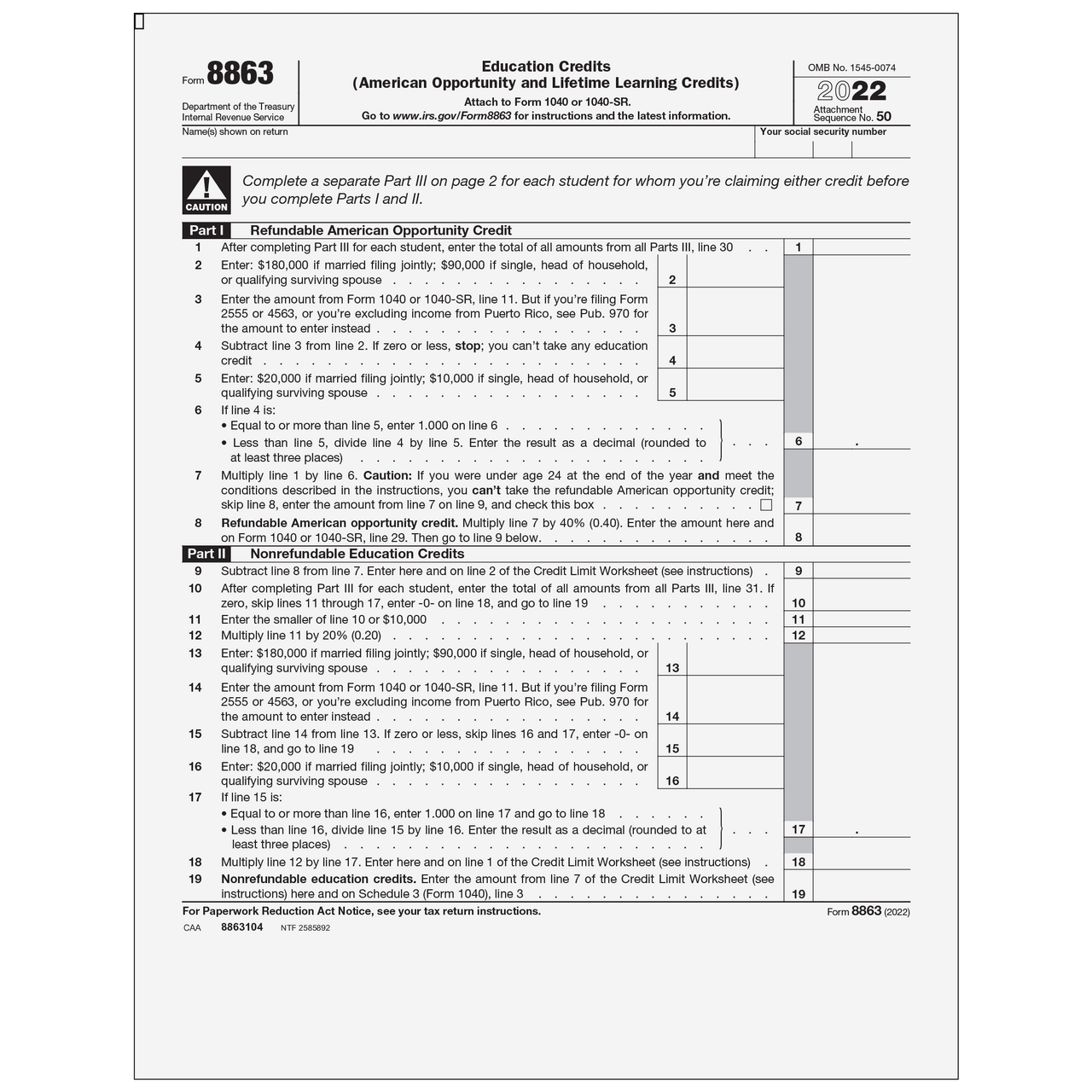

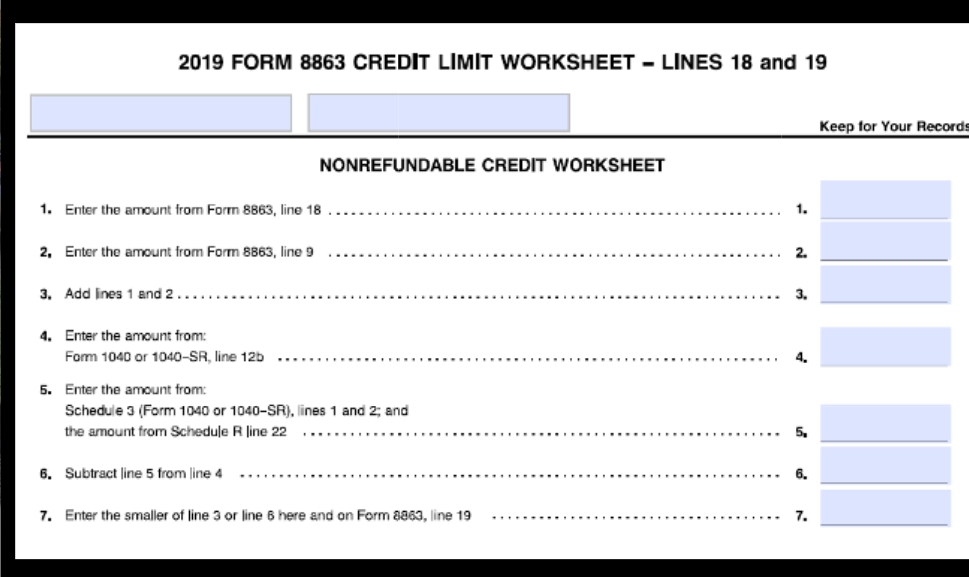

Form 8863 Credit Limit Worksheet is an essential document for taxpayers looking to claim education credits on their federal tax return. This worksheet helps taxpayers determine the maximum amount of credit they can claim based on their expenses for qualified education expenses.

When it comes to claiming education credits, understanding the IRS guidelines and rules is crucial. The Form 8863 Credit Limit Worksheet helps taxpayers navigate through the complex rules and calculations to ensure they claim the correct amount of credit.

The worksheet requires taxpayers to input information such as their adjusted gross income, the amount of qualified education expenses paid, and the type of credit they are claiming (such as the American Opportunity Credit or the Lifetime Learning Credit). Based on this information, the worksheet calculates the maximum credit amount the taxpayer is eligible to claim.

It’s important for taxpayers to fill out the Form 8863 Credit Limit Worksheet accurately and completely to avoid any errors or potential audits from the IRS. Taxpayers should keep all documentation related to their education expenses, such as tuition statements and receipts, in case they need to provide proof of their expenses.

Claiming education credits can help taxpayers reduce their tax liability and save money on their tax bill. By using the Form 8863 Credit Limit Worksheet, taxpayers can ensure they are claiming the maximum credit amount they are eligible for based on their education expenses.

In conclusion, the Form 8863 Credit Limit Worksheet is a valuable tool for taxpayers seeking to claim education credits on their federal tax return. By accurately completing the worksheet and following IRS guidelines, taxpayers can maximize their tax savings and avoid potential issues with the IRS.