In any business, keeping track of cash flow is essential for financial stability and success. One of the most effective tools for managing cash transactions is a cash counting worksheet. This simple document helps businesses accurately count and record cash that comes in and goes out, making it easier to monitor revenue and expenditures.

By using a cash counting worksheet, businesses can ensure that their financial records are accurate and up-to-date. This not only helps in tracking cash flow but also in identifying any discrepancies or potential issues that may arise. It provides a clear and organized way to manage cash transactions, reducing the risk of errors and fraud.

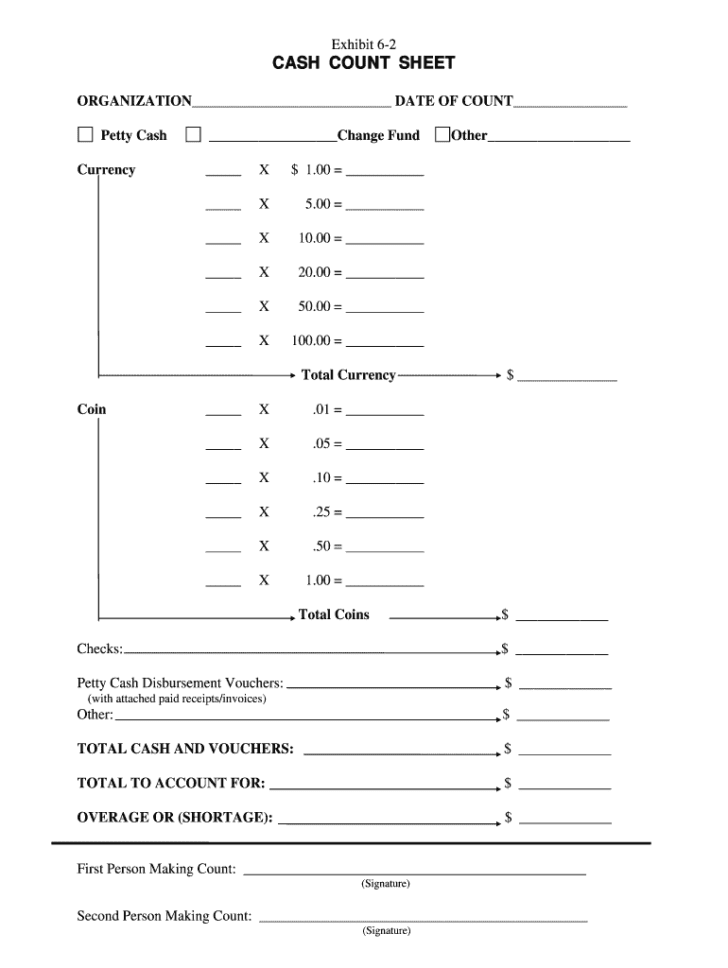

Cash Counting Worksheet

A cash counting worksheet typically includes columns for date, description, cash in, cash out, and running balance. Businesses can customize the worksheet to suit their specific needs and preferences. By consistently updating the worksheet with each transaction, businesses can easily track their cash flow and identify any areas that may need attention.

Using a cash counting worksheet also helps in budgeting and forecasting future cash flow. By analyzing the data recorded in the worksheet, businesses can make informed decisions about their financial health and plan for the future. It provides a clear picture of where the money is coming from and where it is going, allowing businesses to make adjustments as needed.

Furthermore, a cash counting worksheet can be a valuable tool for auditing and compliance purposes. By maintaining accurate and detailed records of cash transactions, businesses can easily provide evidence of their financial activities to auditors, regulators, or other stakeholders. This can help in ensuring transparency and accountability in financial reporting.

In conclusion, a cash counting worksheet is a simple yet powerful tool for businesses to manage their cash flow effectively. By using this document to track cash transactions, businesses can improve financial management, reduce errors, and enhance transparency. It is an essential component of any business’s financial toolkit and can help in ensuring long-term financial stability and success.