When it comes to filing taxes, there are many different credits and deductions available to taxpayers to help reduce their tax liability. One such credit is the Earned Income Credit (EIC), which is designed to assist low to moderate-income individuals and families. To determine the amount of EIC you may be eligible for, you will need to fill out the EIC tax worksheet.

The EIC tax worksheet is a tool provided by the IRS to help taxpayers calculate their potential credit amount. It takes into account various factors such as income, filing status, and number of qualifying children. By following the instructions on the worksheet, you can determine if you qualify for the EIC and how much you may be able to claim.

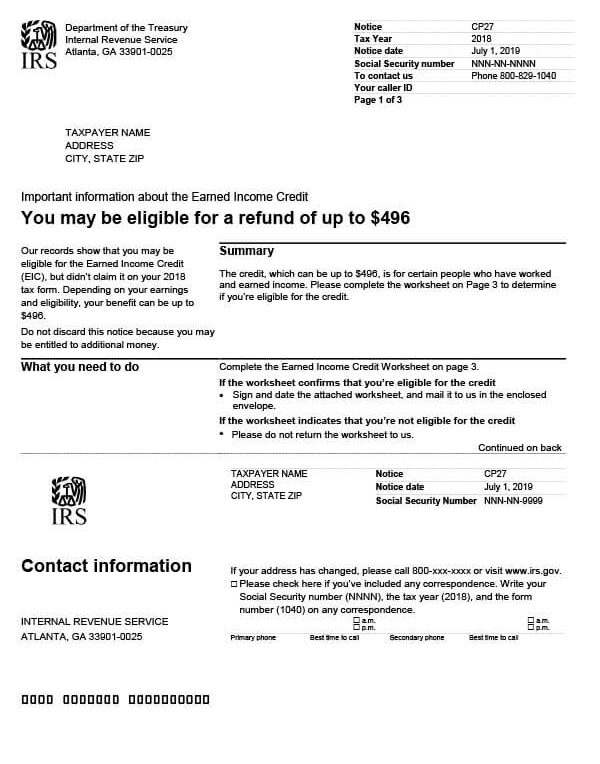

EIC Tax Worksheet

When filling out the EIC tax worksheet, you will need to provide information about your income, expenses, and dependents. The worksheet will guide you through the process of calculating your earned income credit based on your specific circumstances. It is important to fill out the worksheet accurately to ensure you receive the maximum credit you are entitled to.

In addition to income and dependents, the EIC tax worksheet also takes into account any investment income you may have. This can impact the amount of credit you are eligible for, so it is important to include this information when completing the worksheet. By carefully following the instructions provided, you can ensure that you are accurately calculating your EIC.

Once you have completed the EIC tax worksheet, you will be able to determine the amount of credit you are eligible for. This credit can help reduce your tax liability or even result in a refund if the credit exceeds the amount of taxes owed. By taking advantage of the EIC, you can help improve your financial situation and provide additional support for yourself and your family.

In conclusion, the EIC tax worksheet is a valuable tool for individuals and families who may qualify for the Earned Income Credit. By accurately completing the worksheet and following the instructions provided, you can determine the amount of credit you are eligible for and potentially reduce your tax liability. Take advantage of this valuable credit to help improve your financial situation and provide additional support for yourself and your loved ones.