When it comes to buying or selling a home, understanding the cost basis is crucial. The cost basis is essentially the original value of an asset for tax purposes. In the case of a home, it is important to calculate the cost basis accurately to determine capital gains or losses when the property is sold.

One way to keep track of the cost basis of your home is by using a home cost basis worksheet. This worksheet helps you document all the expenses related to the purchase and improvement of your home, which will ultimately determine the cost basis of the property.

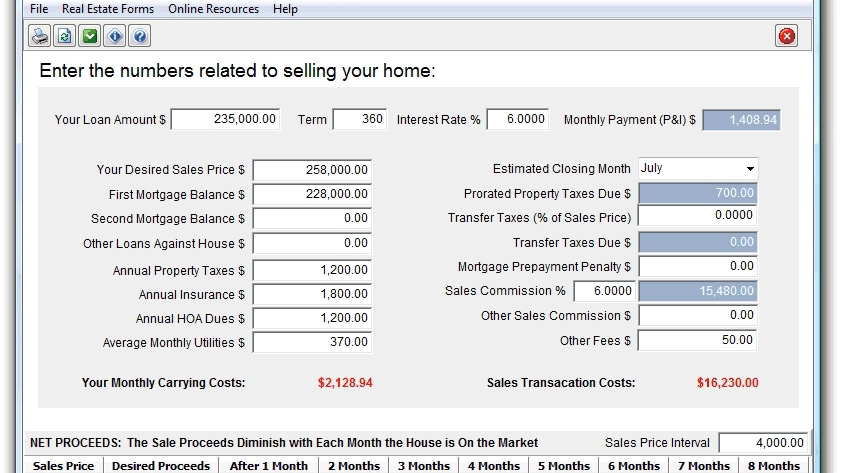

Home Cost Basis Worksheet

A home cost basis worksheet typically includes sections to input the purchase price of the home, closing costs, and any expenses incurred for home improvements. It is important to keep receipts and records of all these expenses to accurately calculate the cost basis.

Additionally, the worksheet may include sections to account for depreciation, as well as any insurance or property taxes paid on the home. All these factors contribute to the overall cost basis of the property.

By using a home cost basis worksheet, homeowners can keep track of their expenses and easily calculate the cost basis of their property when it comes time to sell. This information is essential for accurately reporting capital gains or losses on their tax returns.

It is recommended to update the home cost basis worksheet regularly, especially after making significant home improvements or renovations. This will ensure that the cost basis is always up to date and reflective of the true value of the property.

In conclusion, a home cost basis worksheet is a valuable tool for homeowners to track and calculate the cost basis of their property. By keeping accurate records of expenses and updating the worksheet regularly, homeowners can ensure they are properly reporting their capital gains or losses when it comes time to sell their home.