When it comes to selling your home, there are many factors to consider, including potential tax implications. The IRS home sale worksheet is a valuable tool that can help you calculate the gain or loss on the sale of your home for tax purposes. By using this worksheet, you can ensure that you are accurately reporting your home sale on your tax return.

Whether you are selling your primary residence or a second home, it is important to understand the tax implications of the sale. The IRS home sale worksheet can help you determine your adjusted basis in the property, any capital gains or losses, and any potential tax liabilities. By using this worksheet, you can make sure that you are complying with IRS regulations and reporting the sale accurately.

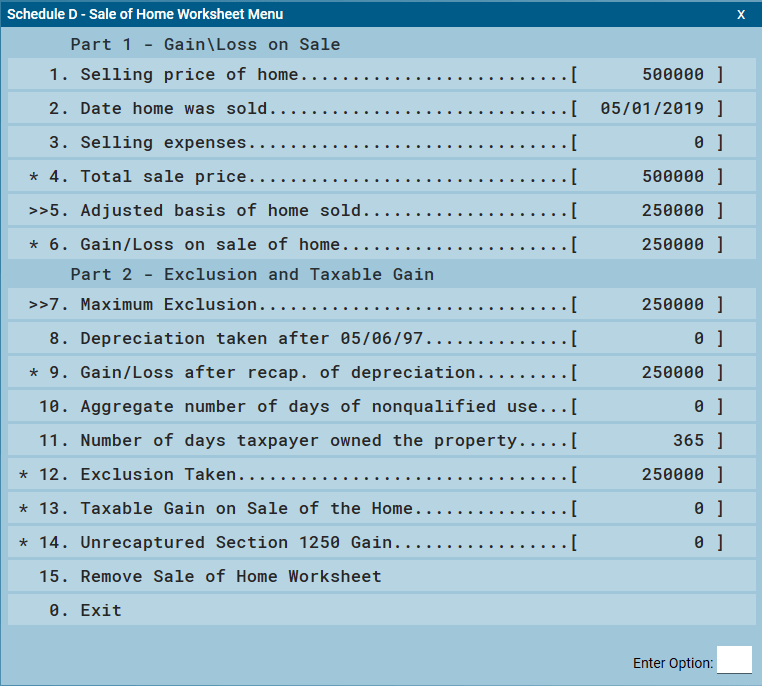

IRS Home Sale Worksheet

The IRS home sale worksheet is a document provided by the Internal Revenue Service to help taxpayers calculate the gain or loss on the sale of their home. This worksheet includes sections for entering information about the purchase price of the home, any improvements made to the property, and selling expenses. By completing this worksheet, you can determine the amount of gain or loss on the sale of your home and report it on your tax return.

When using the IRS home sale worksheet, it is important to carefully review all of the information you enter and ensure that it is accurate. By accurately reporting the sale of your home, you can avoid potential audits or penalties from the IRS. Additionally, using this worksheet can help you take advantage of any tax benefits or deductions that may be available to you as a result of the sale.

Overall, the IRS home sale worksheet is a valuable tool for homeowners who are selling their property. By using this worksheet, you can calculate the gain or loss on the sale of your home and accurately report it on your tax return. This can help you avoid potential tax liabilities and ensure that you are in compliance with IRS regulations. If you are unsure how to use the worksheet or have questions about your specific situation, it may be beneficial to consult with a tax professional for guidance.

In conclusion, the IRS home sale worksheet is an important document for homeowners who are selling their property. By using this worksheet, you can accurately calculate the gain or loss on the sale of your home and report it on your tax return. This can help you avoid potential tax liabilities and ensure that you are in compliance with IRS regulations. If you are unsure how to use the worksheet or have questions about your specific situation, consider seeking guidance from a tax professional.