When facing financial difficulties, dealing with the IRS can add to the stress. However, there is a tool that can help taxpayers determine their insolvency status and potentially avoid tax consequences. This tool is known as the IRS Insolvency Worksheet, which helps individuals calculate their insolvency and understand the implications for tax purposes.

Before diving into the details of the IRS Insolvency Worksheet, it is important to understand what insolvency means in the context of taxes. Insolvency occurs when a taxpayer’s total liabilities exceed their total assets. This can happen due to various reasons such as excessive debt, loss of income, or other financial challenges. When a taxpayer is insolvent, they may be eligible for certain tax benefits or exclusions.

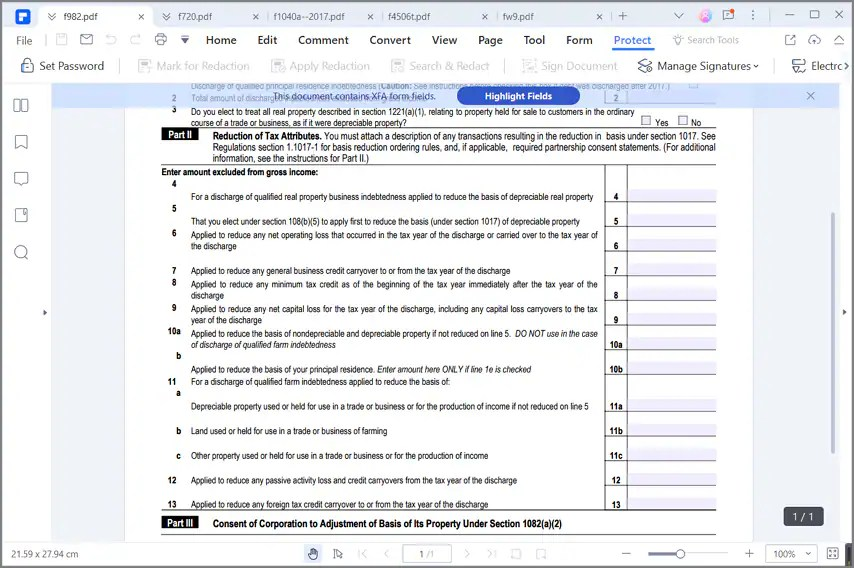

IRS Insolvency Worksheet

The IRS Insolvency Worksheet is a tool provided by the Internal Revenue Service to help taxpayers determine their insolvency status. The worksheet requires individuals to list their assets and liabilities as of a specific date. Assets may include cash, investments, real estate, and personal property, while liabilities may include mortgages, credit card debt, and other outstanding loans.

By completing the IRS Insolvency Worksheet, taxpayers can calculate their insolvency amount, which is the difference between their total assets and total liabilities. If the insolvency amount is greater than the debt forgiven by the IRS, the taxpayer may be considered insolvent and may be eligible for exclusion from taxable income on the forgiven debt.

It is important for taxpayers to accurately complete the IRS Insolvency Worksheet and keep documentation of their calculations in case of an audit or review by the IRS. By utilizing this tool, individuals can better understand their financial situation and potential tax implications related to insolvency.

In conclusion, the IRS Insolvency Worksheet is a valuable resource for taxpayers facing financial challenges and dealing with debt forgiveness. By accurately completing the worksheet and understanding the implications of insolvency, individuals can potentially avoid tax consequences and navigate their financial situation more effectively. If you are unsure about your insolvency status or how to use the worksheet, consider seeking advice from a tax professional for guidance.