When you work multiple jobs, it can be challenging to keep track of your income and tax liabilities. This is where the IRS Multiple Jobs Worksheet comes in handy. This worksheet helps you determine the correct amount of withholding from each paycheck, ensuring that you don’t end up owing a large sum of money at tax time. By using this worksheet, you can avoid any surprises and plan your finances more effectively.

It’s essential to understand how the IRS Multiple Jobs Worksheet works and why it’s crucial for individuals with multiple sources of income. This worksheet takes into account the total amount of income you expect to earn from all your jobs and helps you calculate the appropriate withholding allowances. By filling out this worksheet, you can ensure that the correct amount of taxes is withheld from each paycheck, preventing underpayment or overpayment of taxes.

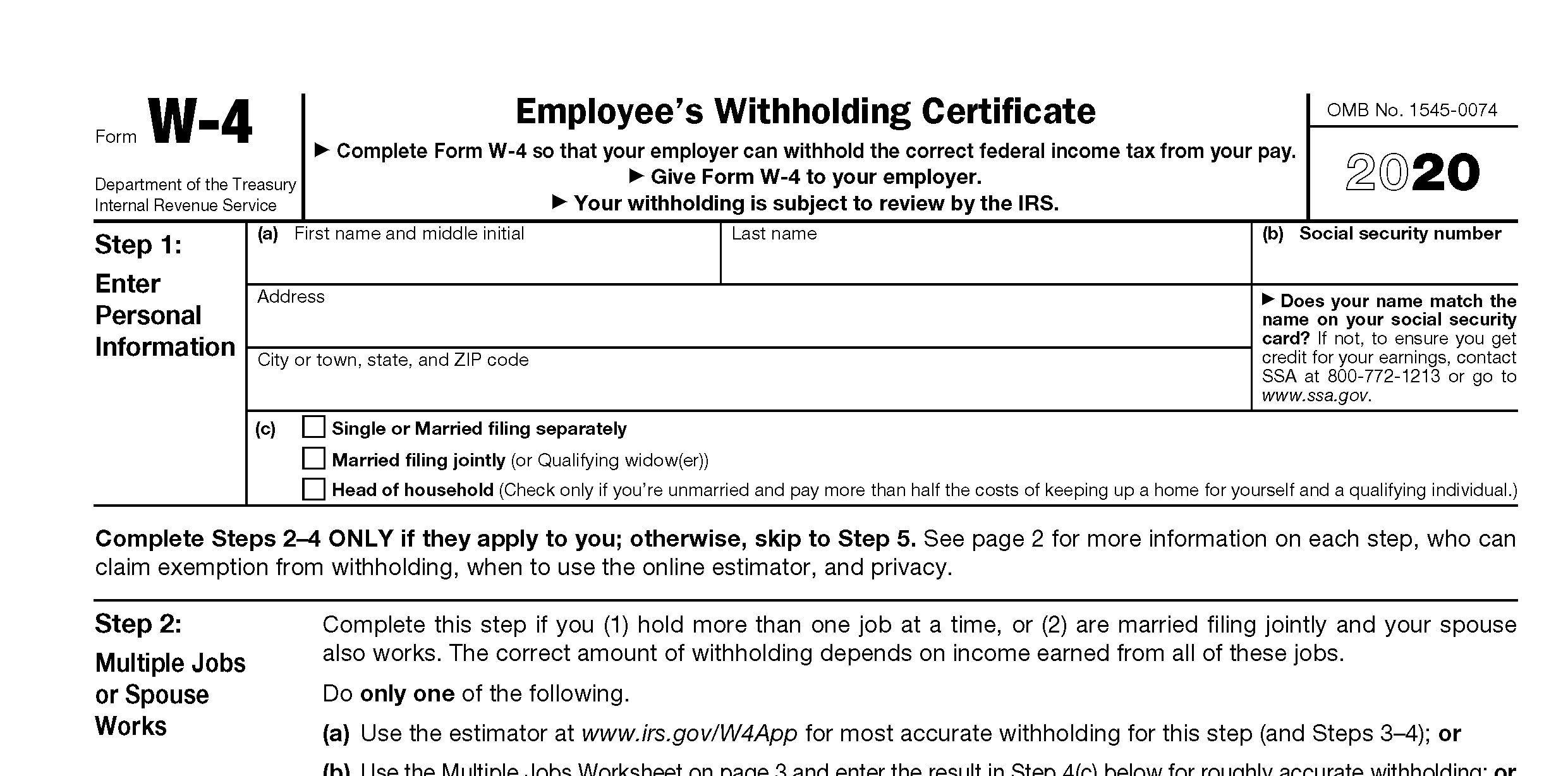

IRS Multiple Jobs Worksheet

The IRS Multiple Jobs Worksheet requires you to input information such as your filing status, total annual income, and the amount of taxes already withheld. By providing this information, the worksheet helps you determine the appropriate number of withholding allowances for each job. This ensures that you meet your tax obligations without having to pay a large sum at the end of the year.

Additionally, the IRS Multiple Jobs Worksheet allows you to factor in any deductions or credits that may apply to your situation. By considering these factors, you can further customize your withholding allowances to accurately reflect your tax liability. This level of detail ensures that you don’t overpay or underpay your taxes, giving you peace of mind when it comes to your financial obligations.

Overall, the IRS Multiple Jobs Worksheet is a valuable tool for individuals who work multiple jobs and want to ensure they are meeting their tax obligations accurately. By using this worksheet, you can avoid any surprises at tax time and plan your finances more effectively. Take the time to fill out this worksheet accurately to ensure that you are withholding the correct amount of taxes from each paycheck.

In conclusion, the IRS Multiple Jobs Worksheet is a useful resource for individuals with multiple sources of income. By using this worksheet, you can ensure that you are withholding the correct amount of taxes from each paycheck, avoiding any financial surprises at tax time. Make sure to take advantage of this tool to stay on top of your tax obligations and plan your finances more effectively.