When selling a home, there are many important factors to consider, including taxes. The IRS Sale of Home Worksheet is a crucial tool that helps homeowners calculate the capital gains or losses from the sale of their property. This worksheet is essential for accurately reporting the sale on your tax return and ensuring compliance with IRS regulations.

By using the IRS Sale of Home Worksheet, homeowners can determine the adjusted basis of their property, which is used to calculate capital gains or losses. This worksheet takes into account various factors such as the original purchase price, any improvements made to the property, and selling expenses. By accurately calculating these figures, homeowners can minimize their tax liability and avoid potential penalties from the IRS.

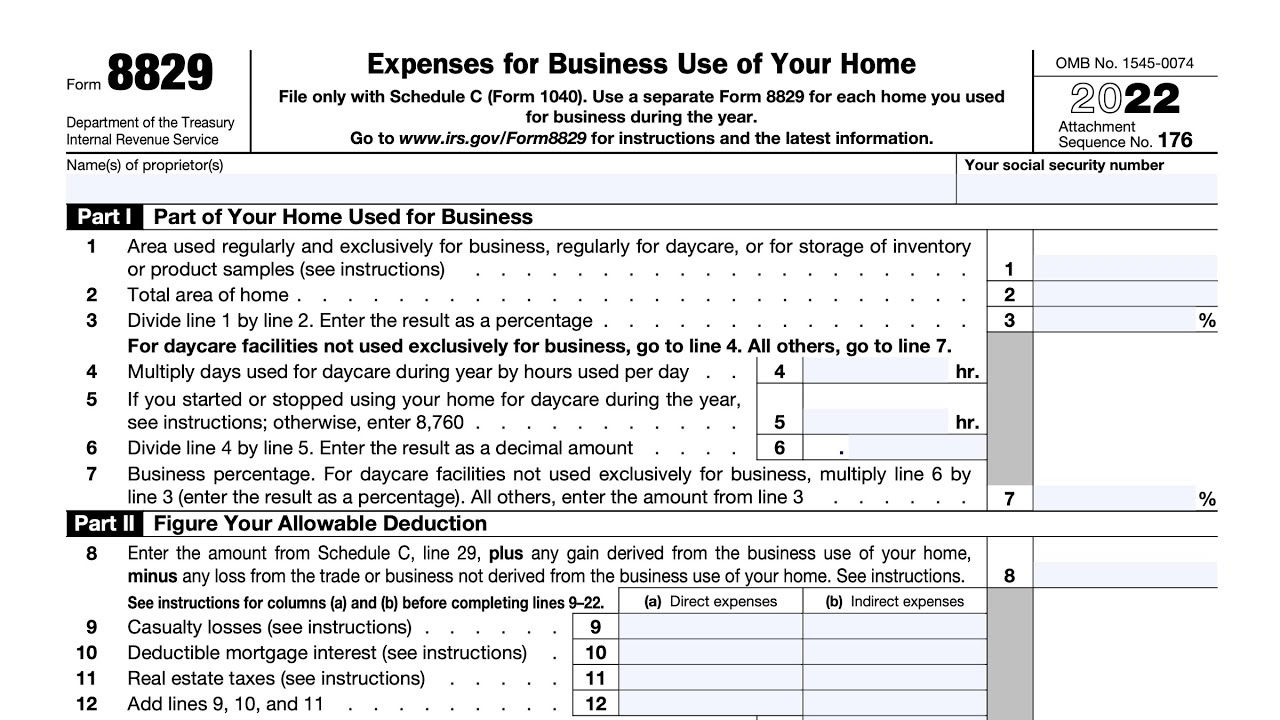

IRS Sale of Home Worksheet

One key aspect of the IRS Sale of Home Worksheet is the exclusion of capital gains for primary residences. Homeowners who meet certain criteria, such as living in the property for at least two of the past five years, may be eligible to exclude up to $250,000 of capital gains ($500,000 for married couples) from their taxable income. This exclusion can result in significant tax savings for homeowners selling their primary residence.

Additionally, the IRS Sale of Home Worksheet helps homeowners calculate any capital gains or losses from the sale of a second home or rental property. By accurately tracking the cost basis and selling expenses of these properties, homeowners can ensure compliance with IRS regulations and avoid potential audits or penalties. This worksheet is a valuable tool for anyone selling real estate and can help simplify the tax reporting process.

In conclusion, the IRS Sale of Home Worksheet is a vital tool for homeowners selling property. By accurately calculating capital gains or losses and taking advantage of exclusions for primary residences, homeowners can minimize their tax liability and ensure compliance with IRS regulations. Using this worksheet can help simplify the tax reporting process and avoid potential penalties from the IRS. It is important for homeowners to consult with a tax professional or financial advisor to ensure they are accurately completing the IRS Sale of Home Worksheet and maximizing their tax savings.