Understanding how Social Security benefits are taxed can be a complex process. One tool that can help individuals determine the taxable portion of their Social Security income is the Taxable Social Security Income Worksheet. This worksheet helps calculate the amount of Social Security benefits that are subject to federal income tax.

It’s important to note that not all Social Security benefits are taxable. The IRS uses a formula to determine the taxable portion of Social Security benefits based on income level. The Taxable Social Security Income Worksheet is a helpful resource for individuals to navigate this process and ensure they are accurately reporting their income on their tax returns.

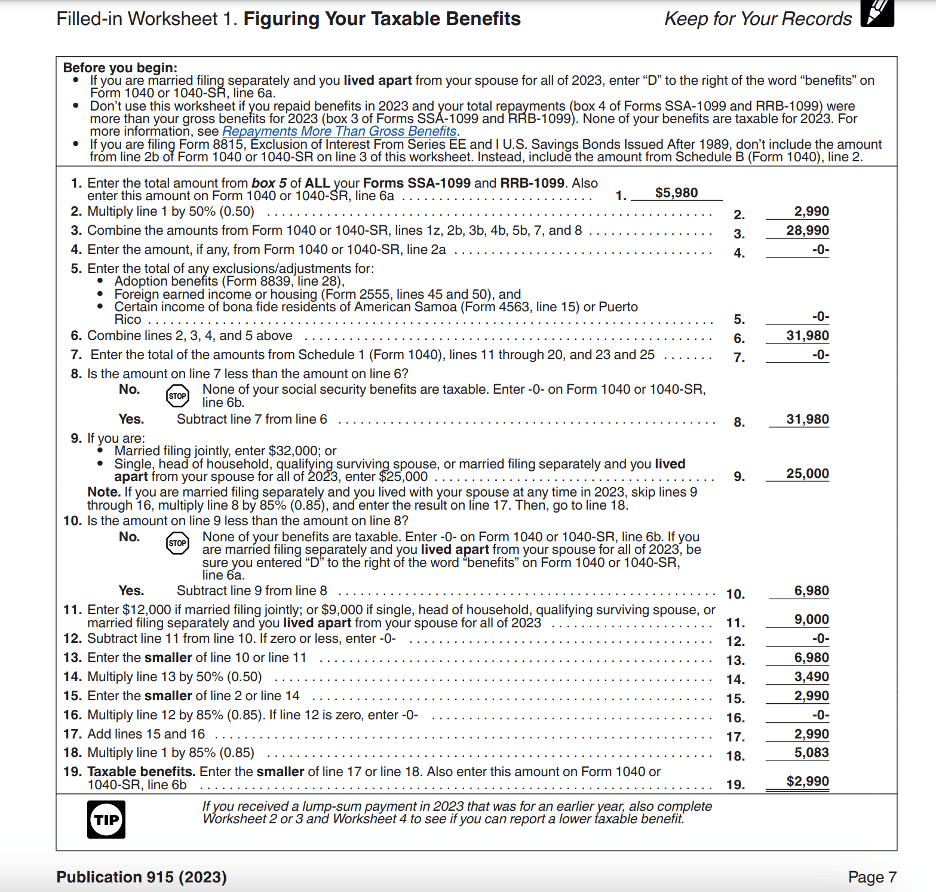

How to Use the Taxable Social Security Income Worksheet

The Taxable Social Security Income Worksheet consists of a series of calculations that take into account various sources of income, including Social Security benefits, to determine the taxable portion of those benefits. Individuals will need to gather information such as their total Social Security benefits received, as well as other sources of income like wages, pensions, and investments.

Once all necessary information is gathered, individuals can fill out the worksheet to calculate the taxable portion of their Social Security benefits. This will help ensure that they are accurately reporting their income and paying the appropriate amount of taxes on their Social Security benefits.

By using the Taxable Social Security Income Worksheet, individuals can avoid underreporting their income and potentially facing penalties from the IRS. It’s important to carefully follow the instructions on the worksheet and double-check all calculations to ensure accuracy.

Overall, the Taxable Social Security Income Worksheet is a valuable tool for individuals to determine the taxable portion of their Social Security benefits and ensure compliance with federal tax laws. By taking the time to fill out the worksheet correctly, individuals can avoid potential issues with the IRS and accurately report their income on their tax returns.

In conclusion, the Taxable Social Security Income Worksheet is an essential resource for individuals to calculate the taxable portion of their Social Security benefits. By using this worksheet, individuals can ensure they are accurately reporting their income and paying the appropriate amount of taxes on their Social Security benefits.