When it comes to selling a property, there are certain tax implications that property owners need to be aware of. One important aspect to consider is the unrecaptured Section 1250 gain, which can have an impact on the taxes owed when selling certain types of property. Understanding how this works is essential for anyone looking to sell real estate.

Unrecaptured Section 1250 gain refers to the portion of a capital gain that is derived from selling a depreciable property. This type of gain is subject to a different tax rate than regular capital gains, so it’s important to calculate it correctly to ensure you are paying the right amount of taxes. The IRS provides a worksheet to help taxpayers determine the unrecaptured Section 1250 gain for their property.

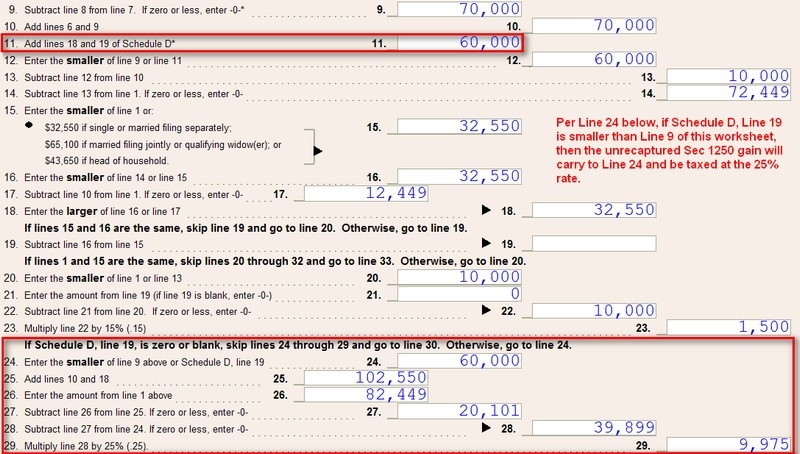

Unrecaptured Section 1250 Gain Worksheet

The unrecaptured Section 1250 gain worksheet is a tool provided by the IRS to help taxpayers calculate the amount of unrecaptured Section 1250 gain from the sale of a property. This worksheet takes into account various factors, such as the original cost of the property, the depreciation taken on the property, and the selling price of the property.

By using the worksheet, taxpayers can determine the amount of unrecaptured Section 1250 gain and calculate the tax owed on that gain. This can help ensure that taxpayers are paying the correct amount of taxes and avoid any potential penalties for underpayment.

It’s important for property owners to carefully complete the unrecaptured Section 1250 gain worksheet when selling a property to ensure they are in compliance with IRS regulations. Failing to properly calculate and report the unrecaptured gain can lead to audits and potential legal consequences, so it’s best to take the time to do it accurately.

In conclusion, the unrecaptured Section 1250 gain worksheet is a valuable tool for property owners looking to sell real estate and understand the tax implications of their sale. By using this worksheet, taxpayers can ensure they are paying the correct amount of taxes on their unrecaptured gain and avoid any potential issues with the IRS. It’s important to take the time to complete the worksheet accurately to avoid any unnecessary complications.