Worksheet on Money

Teaching children about money management is an important life skill that will benefit them in the long run. One way to introduce the concept of money to kids is through worksheets that are both engaging and educational. These worksheets can help children learn about the value of money, how to budget, and the importance of saving.

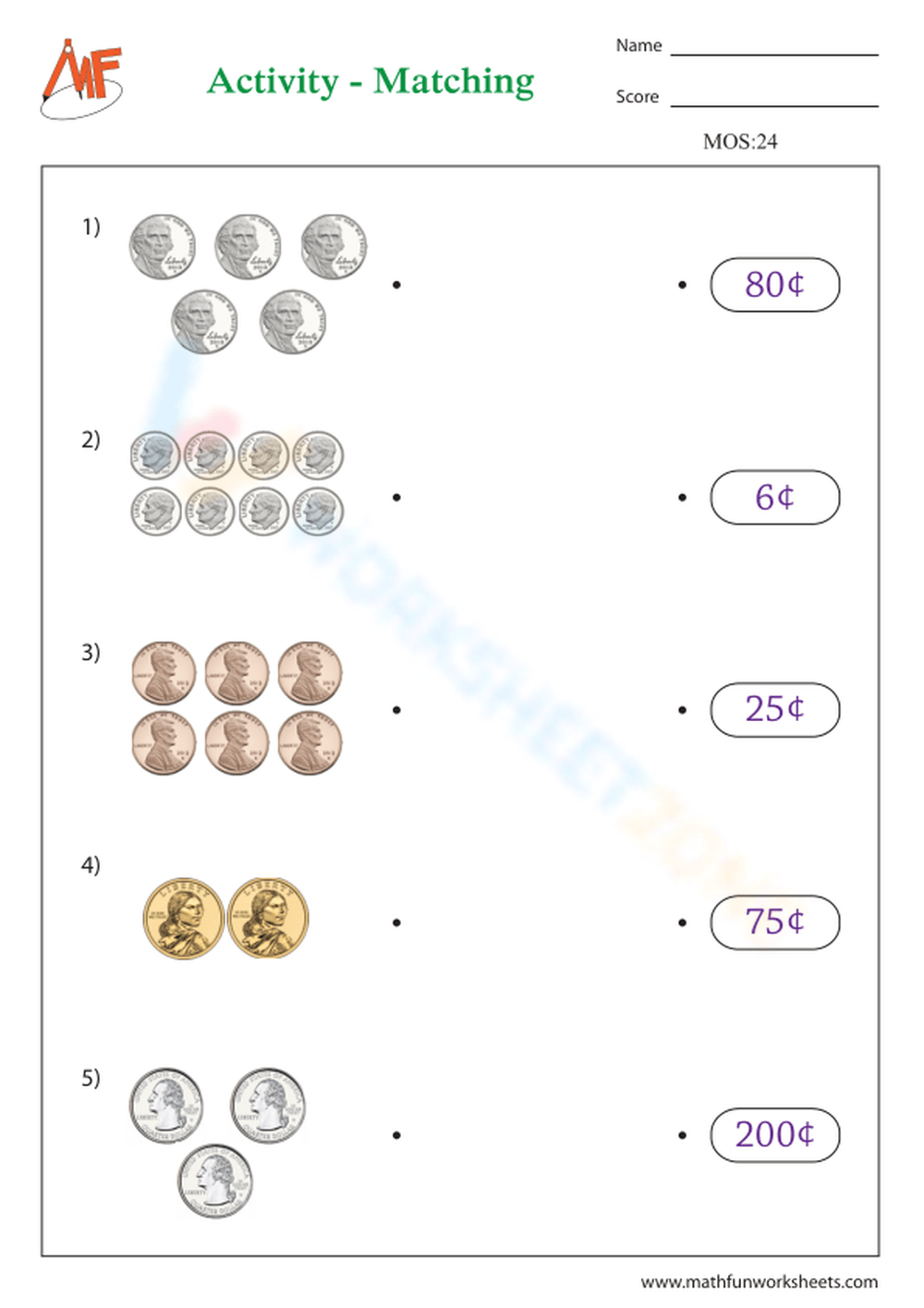

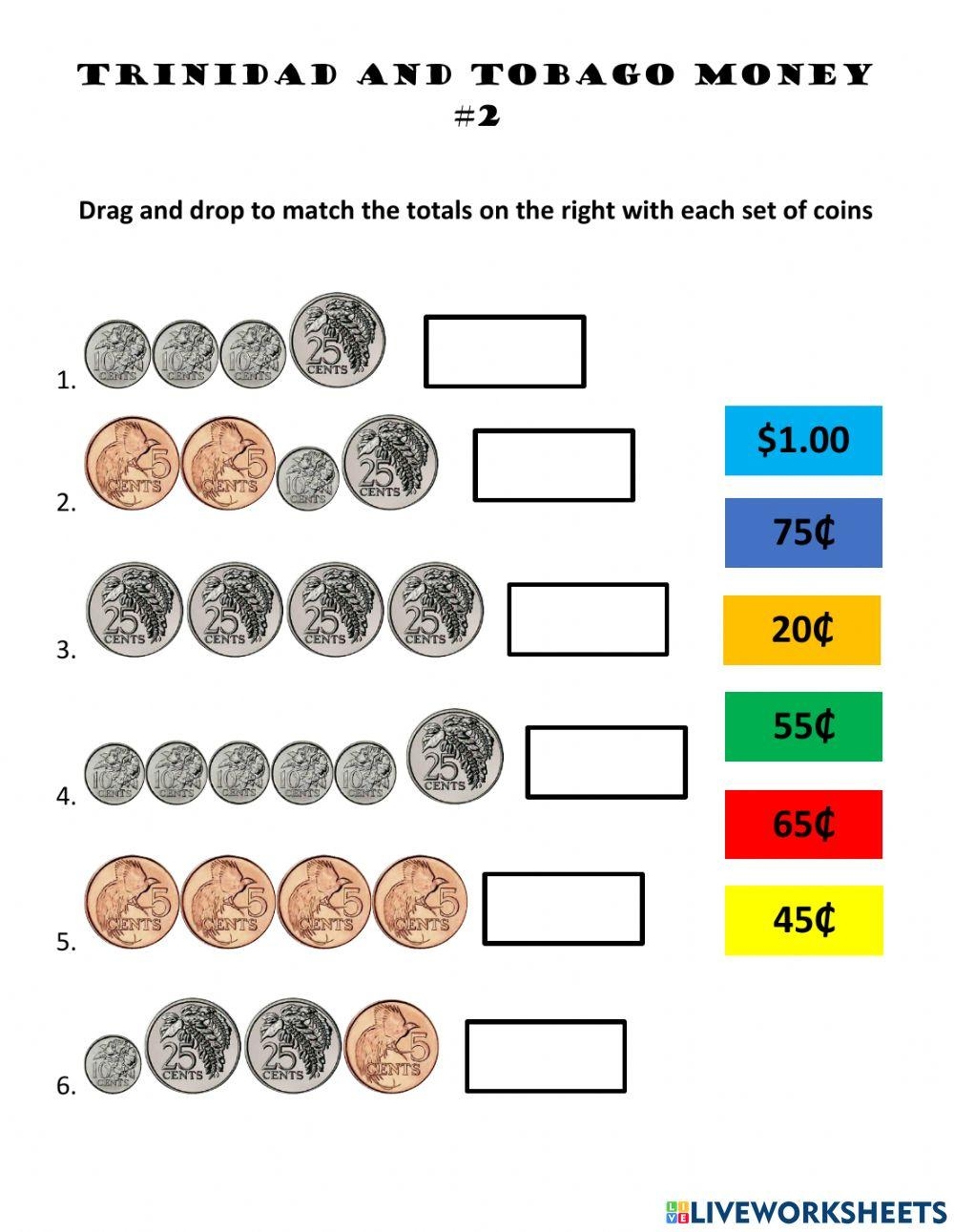

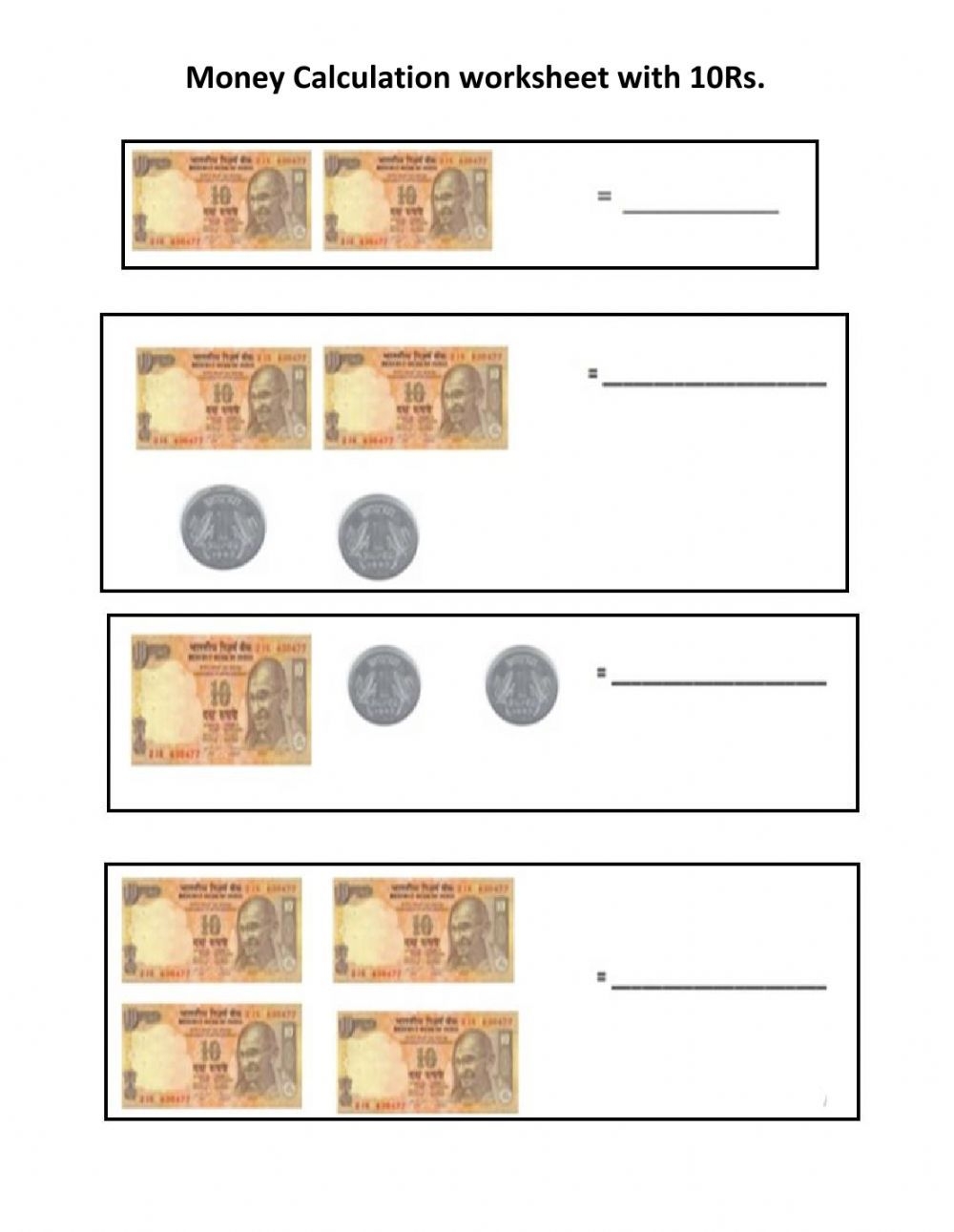

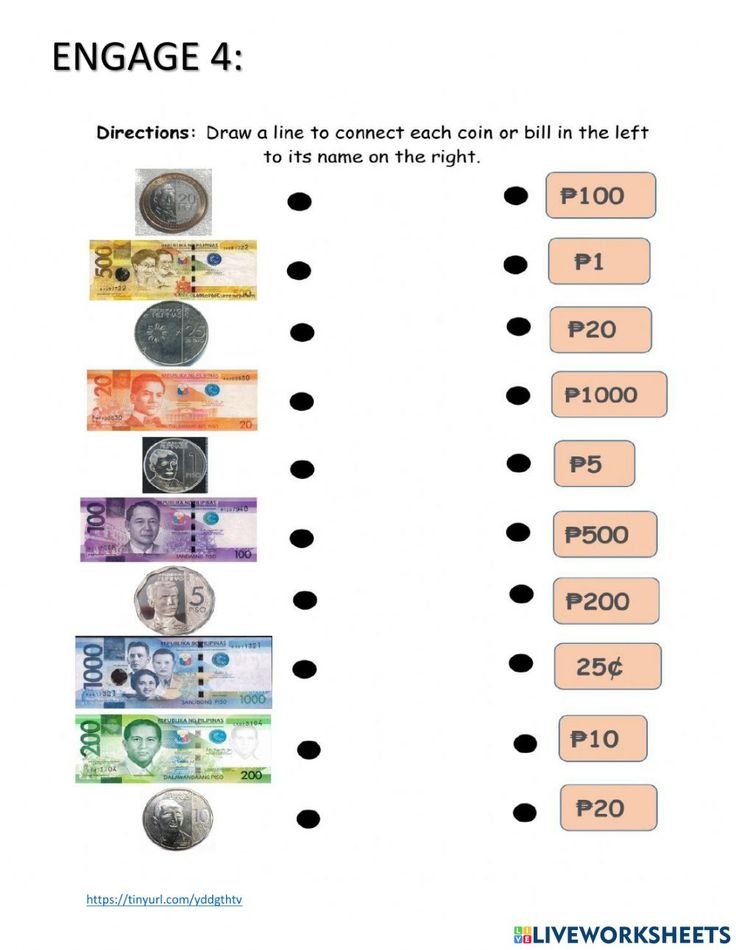

By using worksheets on money, parents and teachers can create a fun and interactive learning experience for children. These worksheets can cover various topics such as counting money, making change, setting financial goals, and distinguishing between needs and wants. Through these activities, children can practice essential math skills while also learning important financial literacy concepts.

Worksheet Examples

One common worksheet on money is a budgeting exercise where children are given a set amount of money and are asked to allocate it towards different categories such as food, clothing, and entertainment. This activity helps children understand the importance of prioritizing expenses and making informed financial decisions.

Another worksheet could involve calculating the total cost of items and determining how much change should be given back. This activity not only reinforces math skills but also teaches children about the value of money and the concept of making purchases within a budget.

Additionally, worksheets on money can include scenarios where children have to make choices between spending their money now or saving it for a future goal. This helps children understand the benefits of delayed gratification and the importance of setting financial goals.

Overall, worksheets on money are a valuable tool for teaching children about financial literacy in a fun and engaging way. By incorporating these activities into their learning, children can develop essential money management skills that will benefit them throughout their lives.

In conclusion, worksheets on money are an effective way to educate children about the value of money, budgeting, and saving. By utilizing these resources, parents and teachers can help children build a strong foundation in financial literacy and empower them to make smart financial decisions in the future.